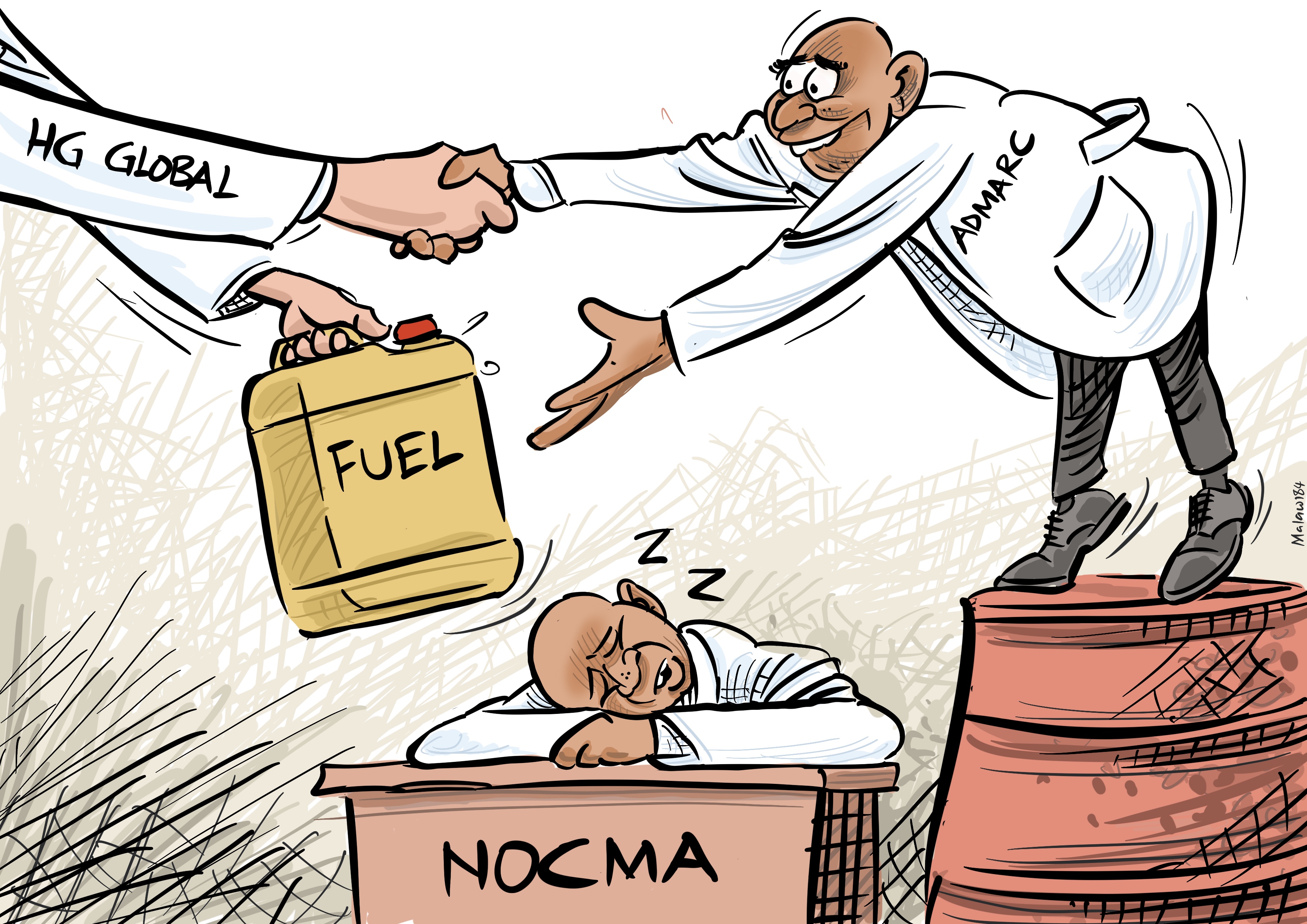

Malawi’s national fuel procurement is increasingly scandalous. Details of a proposed deal by the state bypassed the National Oil Company of Malawi (NOCMA) to permit the equally struggling Agricultural Development and Marketing Corporation (ADMARC) to illegally award a 650 billion kwacha fuel supply contract to a South African company suspected of having Malawian ties at Njerwa in Lilongwe is mind-boggling. JOSEPHINE CHINELE AND JACK McBRAMS Struggling state-owned enterprise, Agriculture Development Marketing Corporation (ADMARC) secured a $323 million (about K650 billion) facility to procure 180 million liters of fuel in early 2024 that could saddle taxpayers with a 26-year debt. The core mandate of Admarc is to facilitate the agriculture sector but documents sourced by the Platform for Investigative Journalism (PIJ) reveal that ADMARC secured the loan from HG Global, a purported finance provider based in South Africa that touts itself as specializing in infrastructure and development projects, to procure the fuel on behalf of state-owned National Oil Company of Malawi (NOCMA). This fuel deal is tied to a five-year Chinese tobacco market opportunity valued at $1 billion, through which Malawi will supply 55,000 tons of tobacco annually. The arrangement involves a memorandum of understanding between Malawi’s Ministry of Agriculture and Hunan Zhongxian La Wei International Trade Limited of China. The details of the deal come amid the chaos that have engulfed the national fuel procurement efforts. NOCMA, by law and traditionally, had the mandate to procure fuel in the country. In September last year, a Malawi News investigation revealed that the Ministry of Transport was illegally procuring 40,000 metric tons of fuel without the involvement of NOCMA. Admarc insists the deal, which involved multiple subcontractors, including Green Global Commodities Limited (GGC) of Zambia, Agro Africa Trade (based at Njerwa in Lilongwe), Baraqah Limited (Zambia), and Alleluia Enterprise of Malawi (also based at Njerwa in Lilongwe), did not take place but documents obtained by PIJ shows advanced procurement plans. Under the proposed arrangement, the documents show, Alleluia Enterprises facilitated the sale of a significant portion of the fuel to HG Global, purportedly addressing forex-related challenges in fuel importation. Alleluia Enterprises subcontracted Baraqah Limited (Zambia) to deliver the fuel. The loan, which covers two months' supply of petrol and four months' supply of diesel, is valued at $153 million (about K300 billion). Repayment terms include a 0.5% interest rate per annum over 25 years. According to documents PIJ has reviewed, the loan will be repaid through proceeds generated from In-Bond Landed Costs after deducting railage costs, road freight costs, clearing and handling charges, brokers' commissions, goods-in-transit insurance, and associated losses. PIJ’s analysis of the correspondence reveals a curious web of corporate interconnections involving Roger Charles Groenewald, who represented three companies—Agro Africa Trading, Alleluia Enterprises, and Green Global Commodities (Zambia) Limited—in this deal. Although Groenewald portrayed these companies as distinct entities, closer scrutiny uncovered significant overlaps. Most notably, Alleluia Enterprises and Agro Africa Trading are both based on adjacent physical addresses: Plot 10/19 and Plot 9/10, Njerwa, Mchinji Road, Lilongwe. The Smoking Gun In a communication from NOCMA Chief Executive Officer (CEO) Clement Kanyama to the Secretary for Energy, it was revealed that NOCMA’s 62nd Extraordinary Board of Directors Meeting held on September 15, 2023, approved the concept of fuel imports financing through ADMARC’s export-oriented program. HG Global did not respond to PIJ's questions on the matter. Baraqah Investments could not be reached via its email address with emails bouncing back. Both ADMARC and NOCMA have categorically denied any involvement in the contentious arrangement. Despite the substantial evidence we presented, ADMARC’s spokesperson, Theresa Chapulapula, offered a terse and dismissive response when questioned by PIJ about the institution's role in the alleged fuel deal. "We did not purchase any fuel," she stated firmly, leaving little room for further elaboration. Similarly, NOCMA has maintained its stance, asserting that it never entered into any agreement with HG Global. This steadfast denial, despite mounting indications to the contrary, raises more questions than answers about the true nature of the dealings and the accountability of the parties involved. Correspondence that we have seen shows that ADMARC CEO Daniel Makata, in a letter dated September 29, 2023, informed NOCMA of an agreement with HG Global to deliver 180 million liters of petrol and diesel. A Web of Suspicious Contracts Adding to the intrigue is the glaring absence of any digital footprint for the companies involved in the arrangement, except HG Global. In today’s interconnected world, a lack of an online presence is highly unusual for businesses engaged in high-stakes commercial transactions. This conspicuous absence further deepens concerns about the legitimacy and transparency of these entities. The convergence of these factors—shared physical addresses, failed communication attempts, and a lack of online visibility—paints a troubling picture of the entities involved in this fuel arrangement. The $323 million fuel deal, critics further argue, violates Section 31 of the Public Procurement Act, which mandates that contracts exceeding K10 billion must be awarded through International Competitive Bidding (ICB). Instead, the arrangement bypassed this legal requirement, prompting questions about accountability and the proper use of public funds. Parliament recently amended procurement laws to allow the government to procure fuel using any government entity as part of efforts to address chronic fuel shortages. However, opposition legislators have warned that the new law could open the door to abuse. “This amendment was rushed and leaves too much discretion in the hands of government officials,” said one opposition MP during the debate. “Without proper safeguards, we are risking a Pandora’s box of corruption and mismanagement.” Notably, the ADMARC-HG Technologies fuel deal was finalized before the passage of the Liquid Fuels and Gas (Production and Supply) Act (Amendment) Bill, which now permits government-to-government fuel procurement. Before this, PIJ had exposed several other questionable deals that bypassed oversight from the Public Procurement and Disposal of Assets (PPDA) Act. Dr. Hillary Kamwendo: A man of many claims HG Global has a previous relationship with the Malawi government. Through its subsidiary HG Technologies (SA), the company previously claimed to be engaging the Malawi government on ambitious infrastructure projects valued at $12.7 billion (K25.4 trillion). These projects included stabilizing Malawi’s energy grid, developing a Green Belt Irrigation project covering 500,000 hectares, building cable cars on Mount Mulanje, and upgrading Malawi’s airports. However, none of these grandiose plans have materialized. Dr. Hillary Kamwendo, CEO of HG Global, describes himself as a strategic management expert with experience advising multiple African governments. His profile includes claims of involvement in the U.S. government’s Electricity for Africa initiative under President Obama. Despite his impressive credentials, the lack of tangible outcomes from his company’s promises in Malawi raises serious questions. READ MORE: Without tender, govt contracts LL forex bureau to supply 128BN worthy of fuel Governance Experts Voice Alarm The decision to involve ADMARC, a parastatal already facing significant financial and operational challenges, has also come under heavy scrutiny. Michael Kaiyatsa, Executive Director of the Centre for Human Rights and Rehabilitation (CHRR), called it “a deeply troubling move that exposes the fragility of Malawi’s fuel procurement system.” “Using ADMARC, which is already struggling to recover, for such a high-stakes deal jeopardizes its viability and could lead to further taxpayer liabilities,” said Kaiyatsa. He noted that the reliance on long-term loans for fuel procurement reflects poor planning and a lack of foresight. “Fuel is the lifeblood of any economy. If procurement processes are flawed, the effects will ripple through critical sectors like transportation, agriculture, and manufacturing, creating an economic burden that affects every Malawian,” he Governance analyst, Wales Chigwenembe, blamed the lack of oversight mechanisms for continued patterns of suspicious deals and likened the deal to past controversial procurements, such as purchasing Affordable Inputs Program (AIP) fertilizer through vendors from butchers and pharmaceutical companies. “The government must learn from these mistakes. Proactive communication and transparency are critical to maintaining public trust. They cannot wait until citizens demand answers,” said Chigwenembe. As Malawi grapples with the implications of this deal, the spotlight remains on the government to prove its commitment to integrity and good governance. For many citizens, the ADMARC case has become a litmus test for whether the leadership prioritizes the public good over private interests. This latest scandal is not an isolated incident. Over the past four years, the Malawi government has been embroiled in several controversial fuel procurement deals that have failed to address the country’s chronic fuel shortages. From inflated contracts to questionable suppliers, these deals have cost taxpayers billions while eroding public trust. Among these is the infamous 2020 contract awarded to a little-known supplier with no prior experience in fuel trading. The deal, which promised to provide a year-long supply of petrol and diesel, collapsed within months, leaving the nation grappling with acute shortages. Another incident in 2022 involved over-inflated pricing on a fuel supply agreement with a Nigerian firm, which led to losses estimated at $50 million. This article was produced by the Platform for Investigative Journalism (PIJ), a non-profit and public interest centre for investigative journalism. READ MORE: NOCMA FILES: ZAMBA, THE CHIEF AND THE DOOMED PLAN OF THE NEW OIL CARTEL WITHOUT TENDER, GOVT CONTRACTS LL FOREX BUREAU TO SUPPLY K128BN WORTH OF FUEL NOCMA FILES: TEMBENU AND NOCMA’S 660 MILLION KWACHA BOUNTY NOCMA FILES: MULLI’S FREE NOCMA MULTIMILLION KWACHA FUEL RIDE ABOUT AUTHORS: Josephine Chinele is an award-winning investigative journalist working with PIJ. She has several international and local awards and has worked for Times Group in the past. Josephine uncovered systemic bullying of students at Kamuzu University of Health Sciences (KUHeS), prompting investigations by the National Council for Higher Education (NCHE) and the KUHeS Council, which found the university culpable of misconduct. Email [email protected] X: @JosephineChinel

.jpg)

.jpg)