BY PIJ REPORTER

FDH Bank is a suspect in K10.4 billion money laundering activities.

This follows unwarranted and unjustified payment made to the bank from the Reserve Bank of Malawi between December 2018 and December 2020 ‘concerning the nature, purpose, and cost of Treasury note programme’.

This has been revealed through a leaked communication from the Director of Public Prosecution (DPP) Steve Kayuni to FDH Bank Chief Executive Officer and copied RBM Governor, demanding a refund of the said K10.4 billion.

In the letter dated February 25, 2022, Kayuni says this total amount of billions were paid to the Bank without any justification or following duly laid down procedures and this, therefore, amounts to suspected money laundering activities.

According to the letter, the amount points to underhand suspicious dealings that FDH Bank was engaging in unjustified enrichment and that the state believes that the K10.4 billion, unjustified wealth are proceeds of Crime.

“Your transaction appeared in May 2021 Deloitte forensic audit report on the payment, operations of the Reserve Bank of Malawi, between January 2019 and June 30, 2020, this was on a credit facility offered by the bank between January 1 2018 and June 2020,” reads part of the letter reference number DPP/ADMIN/ 14X.

“As a competent authority pursuant to the Financial Crimes Act, we intend to institute civil forfeiture proceedings against yourselves for dealing with property that is connected to a financial crime,” the letter adds.

Marked “strictly confidential,” the letter further states that following analysis and subsequent investigations, government strongly believe that the bank, board members, and its senior management personnel may become amenable to answering financial crime charges in the near future.

The state has further warned that failure to pay back the money will force the state to commerce civic forfeiture proceeds.

“Please note that unless the sum of MK 10.4 Billion with interest at commercial rate is repaid to the State and evidence of the same is provided to us or you indicate to us how you intend to repay the said sum within 14 days hereof, we shall take necessary steps to pursue these proceeds of a crime and recover the same in accordance with the law,” said Kayuni in the letter.

When contacted, Kayuni said the communication was confidential and decline to comment further on the matter.

He said: “I can’t comment on privileged information. That communication was confidential.”

FDH Bank Managing Director Noel Mkulichi declined to state the bank’s position on the matter now. He however referred PIJ to FDH Financial Holdings Limited Chief Executive Officer William Mpinganjira insisting the letter is addressed to him.

But efforts to speak to Mpinganjira proved futile as he could not answer his phones on several attempts.

But while commending government efforts on the matter, Centre for Social Accountability and Transparency executive director Willy Kambwandira has asked government to also take to account public officers who were initiating the transactions at Reserve Bank.

He has also demanded transparency on the asset recovery process to ensure accountability of the proceeds.

“We are encouraged with government’s determination to recover ill-gotten proceeds. We are aware that this is a complex process. However, we strongly believe that recovery of the money alone is not enough. We expect criminal charges levelled against people involved in the transactions at the Reserve Bank as well as beneficiaries of the money,” said Kambwandira.

“Again, it is very important for the state to be transparent on the asset recovery process to avoid abuse of the recovered proceeds” he added.

In an audit report spreadsheet that also leaked last year, a total of 195 approved transfers were done by the central bank where a total of K 1, 014, 676, 413, 803.80 was credited to various banks on 26th June 2020.

Our analysis of the spreadsheet shows that majority of the transfers were made to FDH bank where a total of 46 transfers were made by RBM.

The revelation comes when findings of a forensic audit report into local and foreign payments made by Reserve Bank of Malawi (RBM) details how central bank officials allegedly bent their own rules to facilitate payments, including some of which the auditors deemed fictitious.

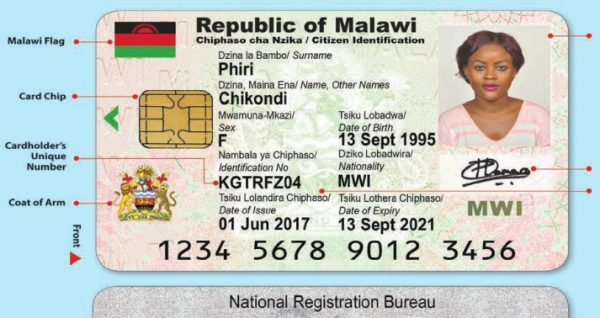

FDH is a commercial bank in Malawi licensed by the Reserve Bank of Malawi with total assets of K218.2 billion (US$303 million) as of 2019.

In August last year, FDH Financial Holdings Limited and its subsidiary FDH Bank plc sued audit firm Deloitte, seeking about K5 billion as compensation for alleged breach of contract in relation to the forensic audit at RBM.

In a joint claim filed at the High Court of Malawi Commercial Division in Blantyre as case number 346 of 2021 on August 30, 2021, FDH Financial Holdings and FDH Bank plc claimed that Deloitte was not supposed to commit to the RBM audit because it was the existing external auditor.

The claimants further submitted that during the period under review covering 2019 and 2020, Deloitte had also audited the group.

FDH argued that Deloitte did not consult them to verify facts before publishing the audit report, saying: “The defendant recklessly described the claimants’ due income in foreign currency dealings of the sum of K6 529 500 000 as constituting compensation.”

Read court documents in part: “The defendant [Deloitte] accepted the said instructions without notifying the claimant and without seeking or obtaining the consent of the claimant as its existing client at the time. “The defendant accepted the said instruction, not caring whether the confidential data of the claimant was at risk or not.”

.jpeg)